India-Japan Bilateral Trade & Market Size

India–Japan bilateral trade continues to demonstrate steady growth, reflecting deepening economic ties between the two countries. In FY 2023–24, total bilateral trade reached approximately US$22.85 billion. During this period, Japan’s exports to India amounted to about US$17.69 billion, while India’s exports to Japan stood at around US$5.15 billion.

In FY 2024–25 (April 2024–January 2025), bilateral trade was approximately US$21 billion. India exported goods worth about US$5.1 billion to Japan and imported around US$15.9 billion from Japan. India’s exports to Japan have shown further improvement, reaching approximately US$6.25 billion in FY 2024–25, covering nearly 3,900 product categories, including engineering goods, chemicals, electronics, and pharmaceuticals.

Several Indian companies have established operations or substantial business activities in Japan, reflecting deepening economic engagement between the two countries. According to data compiled on cross-border business activity, more than 100 Indian companies are currently working in Japan across sectors such as IT services, consulting, and digital transformation. These firms support Japanese enterprises with technology solutions, enterprise services, and strategic business functions.

Trade Trend

Overall bilateral trade has expanded from around US$15.3 billion in FY 2020–21 to approximately US$25.15 billion in FY 2024–25, indicating a consistent upward trend.

In global trade rankings, India is Japan’s 18th largest trading partner with a 1.4% share, while Japan ranks 17th in India’s global trade with a 2.1% share.

Source: https://www.indconfukuoka.gov.in/page/bilateral-brief/

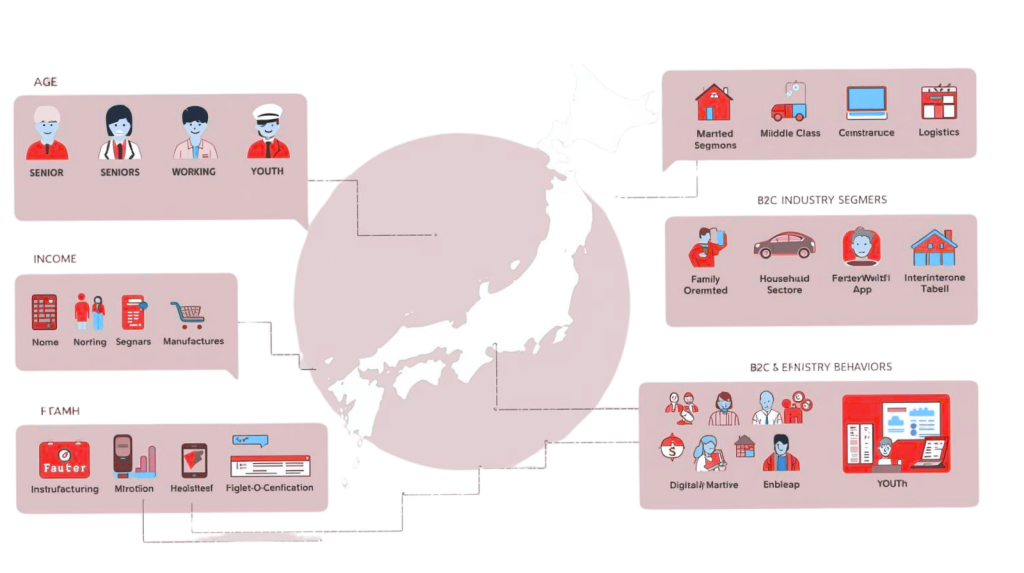

Japan Customer Segmentation

(B2B , by Industry, Age Group, Income Tier)

1. Demographic & Age Group Segments

Japan’s population has a distinctive age profile with a very high median age (49.9 years) and one of the world’s largest elderly populations — nearly 30 % aged 65 +, and only about 11 % under 15 years. This creates strong demand in sectors like healthcare, elderly services, leisure, and financial products for retirees. Conversely, younger age groups (15–64 years) remain key for technology, entertainment, travel, and family-oriented consumption. (1)

2. Income & Consumption Capacity

Japan is a high-income developed economy with relatively strong per-capita disposable income compared to global averages. While income inequality exists, the middle-class segment dominates consumer spending, with high purchasing power in urban centres such as Tokyo, Osaka, and Yokohama. High-income consumers tend to favor premium, quality, and trusted brands, whereas price-sensitive tiers focus on cost-performance and discount channels (2).

3. B2B Segmentation & Industry Demand

Japan’s mature economy supports wide B2B activity in sectors like manufacturing, automotive, electronics, logistics, and IT services. The B2B e-commerce market in Japan is enormous (estimated in the trillions USD), reflecting strong digital ordering and supply chain integration among businesses across industries. Foreign entrants can tap B2B demand via partnerships, distributors, or online platforms tailored to Japanese corporate procurement preferences (3).

4. B2C Consumer Characteristics

Japan’s consumer market can broadly be viewed across three key age-based segments. Senior consumers (“Silver Market”), driven by Japan’s aging population, generate strong demand for products and services related to healthcare, wellness, mobility, and leisure, and they place high importance on reliability, brand trust, and consistently high-quality service. Working-age adults in their 30s–40s typically prioritize practical and value-for-money products that balance quality with cost efficiency, particularly to support family life and career needs. Meanwhile, digital and younger consumers (Gen Z and Millennials) are highly digitally native, with strong engagement in e-commerce, mobile platforms, and social media; their purchasing behavior is shaped by experiences, technology, and lifestyle-oriented brands, and they rely heavily on online channels for product discovery and purchasing decisions (4).

Source:

- Wikipedia, https://en.wikipedia.org/wiki/Demographics_of_Japan

- JAPANESE CONSUMERS` BEHAVIOR: BY AGE AND GENDER, by Prof. Dr. Parissa Haghirian January 2011 https://cdnw8.eu-japan.eu/sites/default/files/2021-01-japanese-consumers-behavior_0.pdf

- Japan Country Commercial Guide, https://www.trade.gov/country-commercial-guides/japan-ecommerce-0

- JAPANESE CONSUMERS` BEHAVIOR: BY AGE AND GENDER, by Prof. Dr. Parissa Haghirian January 2011 https://cdnw8.eu-japan.eu/sites/default/files/2021-01-japanese-consumers-behavior_0.pdf